eCommerce: Footwear Market

Amazon's Growing Role in Shoe Shopping

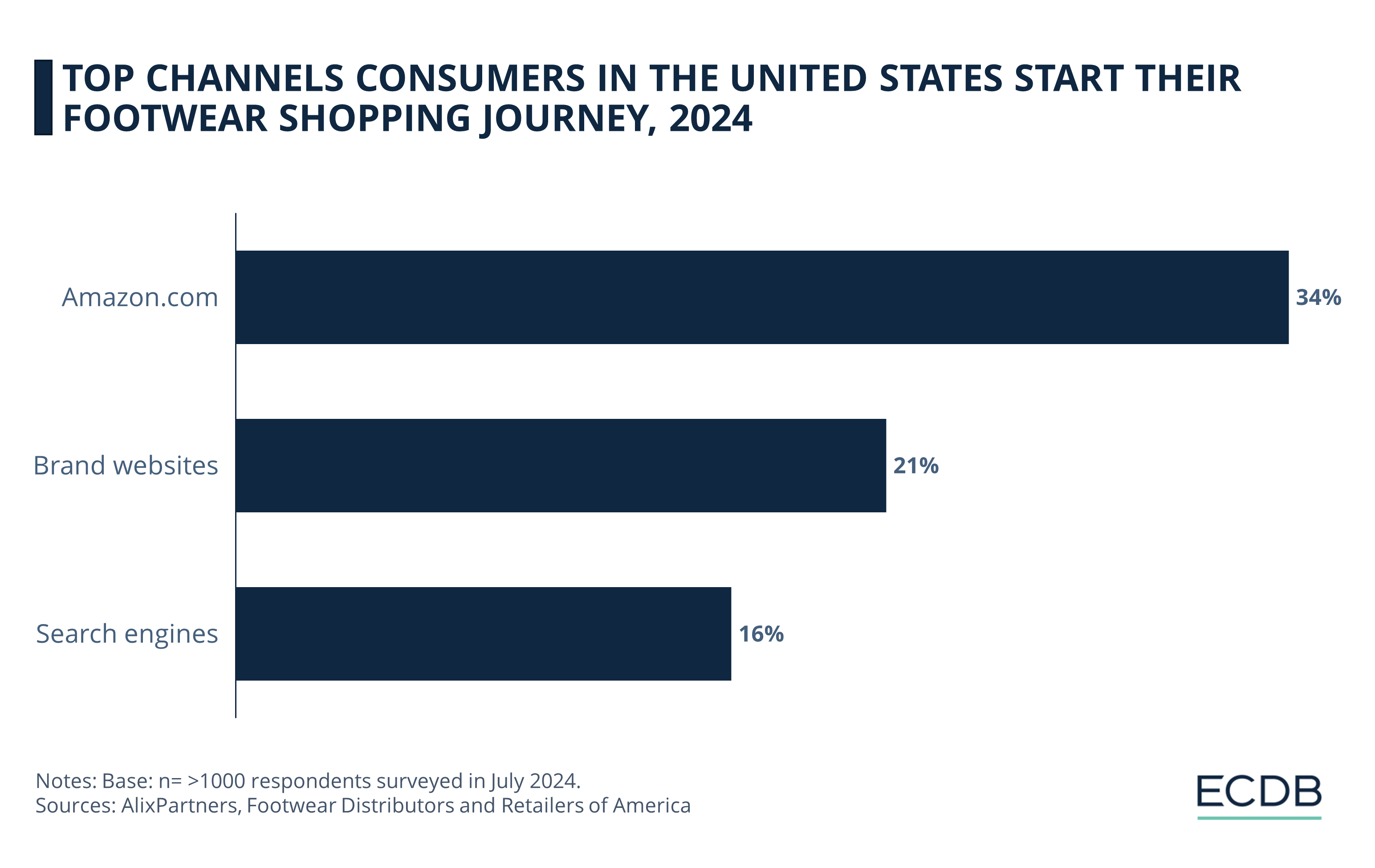

Did you know that one third of shoppers in the U.S. start their shoe search on Amazon? The retail giant leads the market, but it is also popular for inspiration.

Article by Cihan Uzunoglu | August 02, 2024

Amazon Footwear Sales: Key Insights

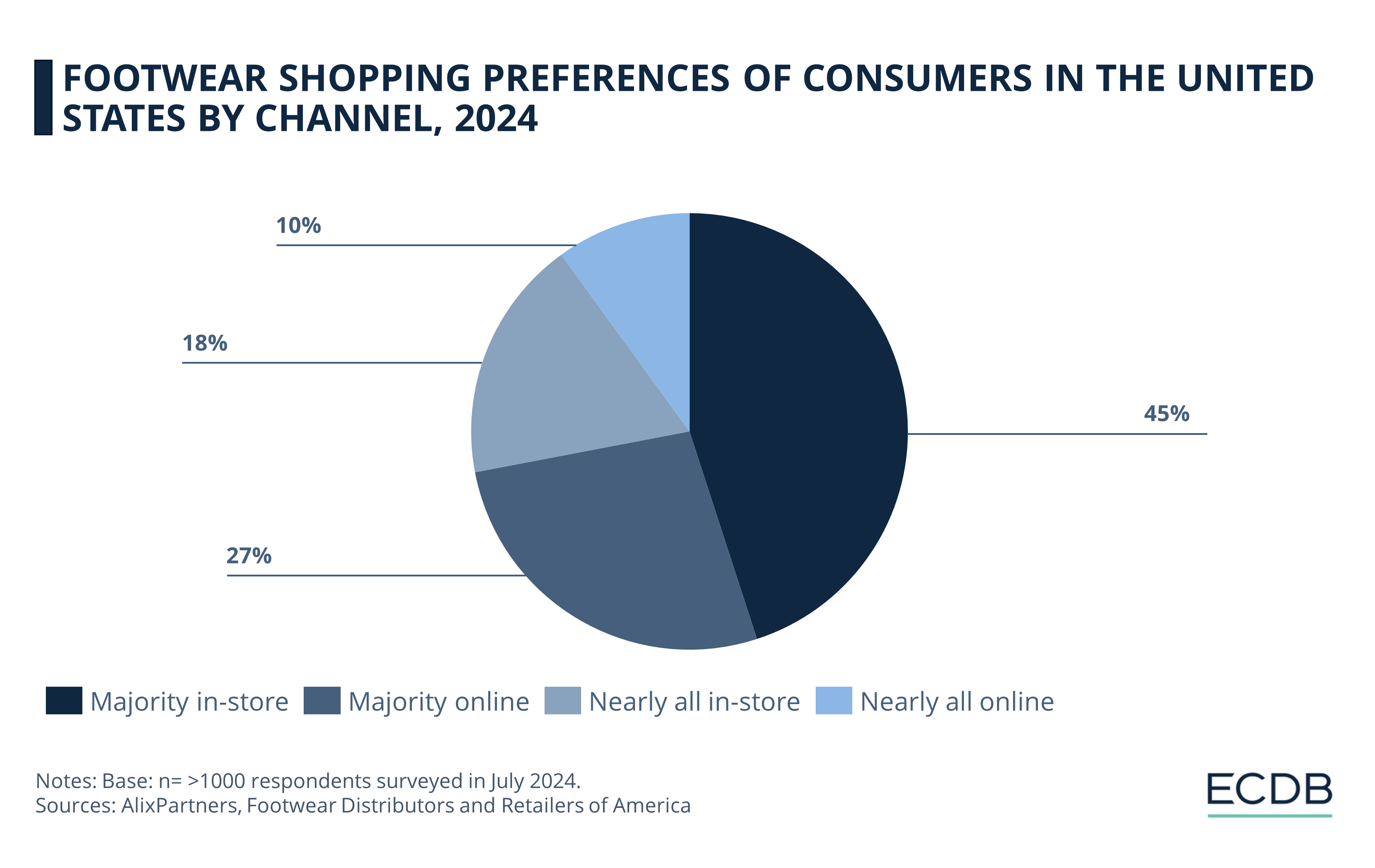

In-Store Preference: Although Amazon is commonly used as a search engine for shoes, 63% of U.S. consumers still prefer purchasing their footwear in physical stores, underscoring the continued significance of brick-and-mortar retail amid the rise of online shopping.

Amazon Integration: Brands like Allbirds, Rothy’s, and Crocs have adopted Amazon as part of their strategies, helping Amazon secure its position as a top online footwear retailer, with 34% of U.S. consumers starting their shoe shopping journey on the platform.

Amazon owns a big chunk of the shoe shopping business, even though it might not be the primary channel for purchasing footwear.

According to the 2024 U.S. Consumer Footwear survey by AlixPartners and the Footwear Distributors & Retailers of America (FDRA), about one-third of consumers start their shoe shopping on Amazon.

Where Do People Buy Shoes

in the United States?

Consumers use Amazon as a search engine to filter shoes based on images, reviews, colors, and availability. However, 63% of shoppers still prefer to buy their shoes in stores. Here are the detailed shopping preferences of U.S. consumers by channel in 2024:

Majority in-store (45%): The largest segment of consumers still prefers in-store shopping, emphasizing the importance of physical retail.

Majority online (27%): A significant portion of shoppers are comfortable buying most of their footwear online.

Nearly all in-store (18%): A notable group remains highly loyal to in-store purchases.

Nearly all online (10%): A smaller, yet important, segment relies almost entirely on online shopping, highlighting the need for robust eCommerce platforms.

FDRA President and CEO Matt Priest noted that while in-store purchases remain dominant, the internet significantly influences spending decisions. Retailers and brands must adopt a multi-channel approach to capture consumer attention and spending.

Brand Strategies on Amazon

In response to this trend, several shoe brands have incorporated Amazon into their strategies.

Allbirds launched select styles on Amazon in November, including the Wool Runner and Tree Runner. Rothy’s debuted its Amazon storefront in May, featuring styles like The Point and The Flat. Crocs has benefited from converting its Amazon presence to a third-party model, selling directly to consumers via the marketplace.

Despite accounting for just under 2% of its net eCommerce sales, amazon.com's US$2.5 billion in footwear sales places it among the top 5 online stores in the global market. At US$2.43 billion, the online store is the top online footwear retailer in the U.S.

Let's look at where consumers in the U.S. typically start their footwear shopping journey in 2024:

Amazon.com (34%): Amazon is the top starting point for a significant number of consumers, acting as a primary search engine for footwear.

Brand websites (21%): Many shoppers begin their journey on brand websites, indicating strong brand loyalty and direct engagement.

Search engines (16%): A considerable number of consumers use search engines to find footwear, showing the importance of SEO and online visibility.

Importance of Multi-Channel Presence

Conversely, brands that have left Amazon faced challenges. Nike, for instance, cut ties with Amazon in 2019 and subsequently lost control over its brand identity on the platform. This allowed resellers to influence Nike’s pricing, appearance, and customer experience.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

eCommerce consultant Rutger Wismeyer emphasized the importance of brands being present where consumers are, including Amazon. This approach is crucial not only in the U.S. but also in Europe.

Sources: Footwear News, AlixPartners, ECDB

Related insights

Deep Dive

eCommerce in Australia: Market Expected to Hit US$75.2 Billion by 2028

eCommerce in Australia: Market Expected to Hit US$75.2 Billion by 2028

Deep Dive

Top Online Fashion Stores in the United States: Will Shein Surpass Amazon?

Top Online Fashion Stores in the United States: Will Shein Surpass Amazon?

Deep Dive

Adidas AG Business Strategy: Why It Lags Behind Its Main Competitor Nike

Adidas AG Business Strategy: Why It Lags Behind Its Main Competitor Nike

Deep Dive

European eCommerce Market Size 2024: Worth 1 Trillion Dollars Soon

European eCommerce Market Size 2024: Worth 1 Trillion Dollars Soon

Deep Dive

Shein Business Model: Growth, Target Audience, Marketing Strategy

Shein Business Model: Growth, Target Audience, Marketing Strategy

Back to main topics