eCommerce in France: Wine & Liquors

Top Online Wine and Liquors Online Stores in France

France, wine and alcohol belong together – or is it a cliché? The French eCommerce market around the subcategory of Wine & Liquors can tell us more.

Article by Antonia Tönnies | August 01, 2024Download

Coming soon

Share

Top Online Wine and Liquors Stores in France:

Key Insights

Leading Online Retailers: Top players in the Wine & Liquors eCommerce market in France include vinatis.com, millesima.fr, whiskey.fr, drinksco.fr, and lepetitballon.com, each with varying degrees of focus on the French market.

Revenue Trends: The French Wine & Liquors eCommerce market experienced significant growth during the COVID-19 pandemic. The revenues were rising from US$1.9 million in 2019 to US$3.3 million in 2023.

Market Dynamics in France: Spirits lead the market share in the French Wine & Liquors eCommerce sector with 58.9%, compared to wine's 41.1%, reflecting a stable trend in the breakdown of net eCommerce revenue.

Future Growth Development: The French Wine & Liquors eCommerce market is expected to grow at a compound annual growth rate (CAGR) of approximately 8%, reaching US$4.7 million by 2028

What is part of French culture like an after-work beer in Germany? Right, a glass of wine in the evening, also called "l’apéro". It is a special event before dinner, mostly with alcoholic drinks.

French culture loves to celebrate the little things in life, including wine and liquor, but does the French eCommerce industry love the same? Who are the key players driving the specialty alcohol market? What can we expect to see in the coming years? Here are the answers with the help of ECDB data.

What Is the Online Wine & Liquors Market?

The Wine & Liquors eCommerce market is a submarket of the Alcoholic Beverages market, which includes products like red wine, white wine, rosé wine, whiskey, vodka, rum, gin, and tequila. Out-of-scope are alcoholic drinks such as beer, sparkling wine, and champagne. Further categories within the Alcoholic Beverages market are beers, and Other Alcoholic Beverages.

Who Is the Leading Online Wine & Liquors Store in France?

The Wine & Liquors market accounts for 75.1% of the Alcoholic Beverages eCommerce market in France. Who are the top 5 specialist Wine & Liquors stores in France?

1. Vinatis.com

The number one Wine & Liquors site in France is vinatis.com, operated by the multinational company Vinatis S.à.r.l. In 2023. The store produced net sales of US$54.5 million, a decrease of 0.4% compared to 2022. In total, 91.9% of its total eCommerce net sales (US$59.3 million) were made in France alone, followed by Switzerland with 2.2%.

Taking a look at the chart, it becomes clear how this alcoholic beverage store has maintained the top position in the ranking, even though it has experienced a decline in year-over-year growth over the past two years. For 2024, ECDB analysts predict that Vinatis will break out of the negative growth curve and increase its eCommerce revenue by 14.9%, reaching total net sales of US$68.1 million.

2. Millesima.fr

In second position comes millesimal.fr, which generated a net eCommerce revenue of US$31.7 million in 2023, an increase of 7% from the previous year. This corresponds to 53% of the revenue of its biggest rival, vinatos.com. The online store for wine and spirits is operated by Millesima S.A. and is fully focused on the French market.

Millesima is one of the online stores that greatly benefited from the eCommerce boom during the COVID-19 pandemic. Revenues soared in 2020 and 2021, jumping from net sales of US$13.2 million in 2019 to US$27.4 million in 2021, an increase of more than double.

3. Whiskey.fr

Next in line on the list is whiskey.fr, operated by La Maison Du Whiskey SJSC - in English, “the house of whiskey”. As the name suggests, the focus here lies more on spirits than wine. In 2023, the online liquor store generated eCommerce net sales of US$23 million, representing a 7.6% decline over the prior year. This represents 90% of La Maison Du Whiskey's global net sales (US$ 25.6 million) earned in France, followed by Belgium with 8%.

Thanks to the eCommerce boom, the online store peaked in terms of revenue at US$37.2 million in 2021. After the corona rush, its annual development collapsed to -25.7% and remains in this cycle of decline. For 2024, we forecast a decrease of 1.9% with net sales of US$25.1 million.

4. Drinksco.fr

In fourth place follows drinksco.fr, which in 2023 recorded eCommerce net sales of US$14.1 million, a drop of 10.1% compared to 2022. The online shop generated this revenue exclusively in France and focuses to 85.7% on the Beverages category, which includes Wine & Liquors. The site also offers products in the categories of Furniture & Homeware (6.6%) and Personal Care (3.4%).

The past evolution of drinksco.fr is marked by strong ups and downs: In 2020, the business grew by 141.5%, rising from a turnover of US$5.6 million in 2019 to US$20 million in 2021. Thereafter, the annual expansion declined and is expected to continue this year with a net sales forecast of US$12.8 million.

5. Lepetitballon.com

Last but not least, lepetitballon.com rounds out the ranking with its nationally focused online store operated by Amazon CS Ireland, Ltd. In 2023, the business achieved total eCommerce net sales of US$12.9 million, a deceleration of 7.8% compared to the previous year.

From 2019 to 2020, le petit ballon – in English, "the little balloon" –, which is specialized in wine, jumped from US$12.3 million to US$20.3 million, an increase of 64.4%. However, after peaking in 2020, the YoY growth rate began to decline, and this negative trend continues to this day, with a net sales forecast of US$12.5 million for the current year, a decrease of 2.8%.

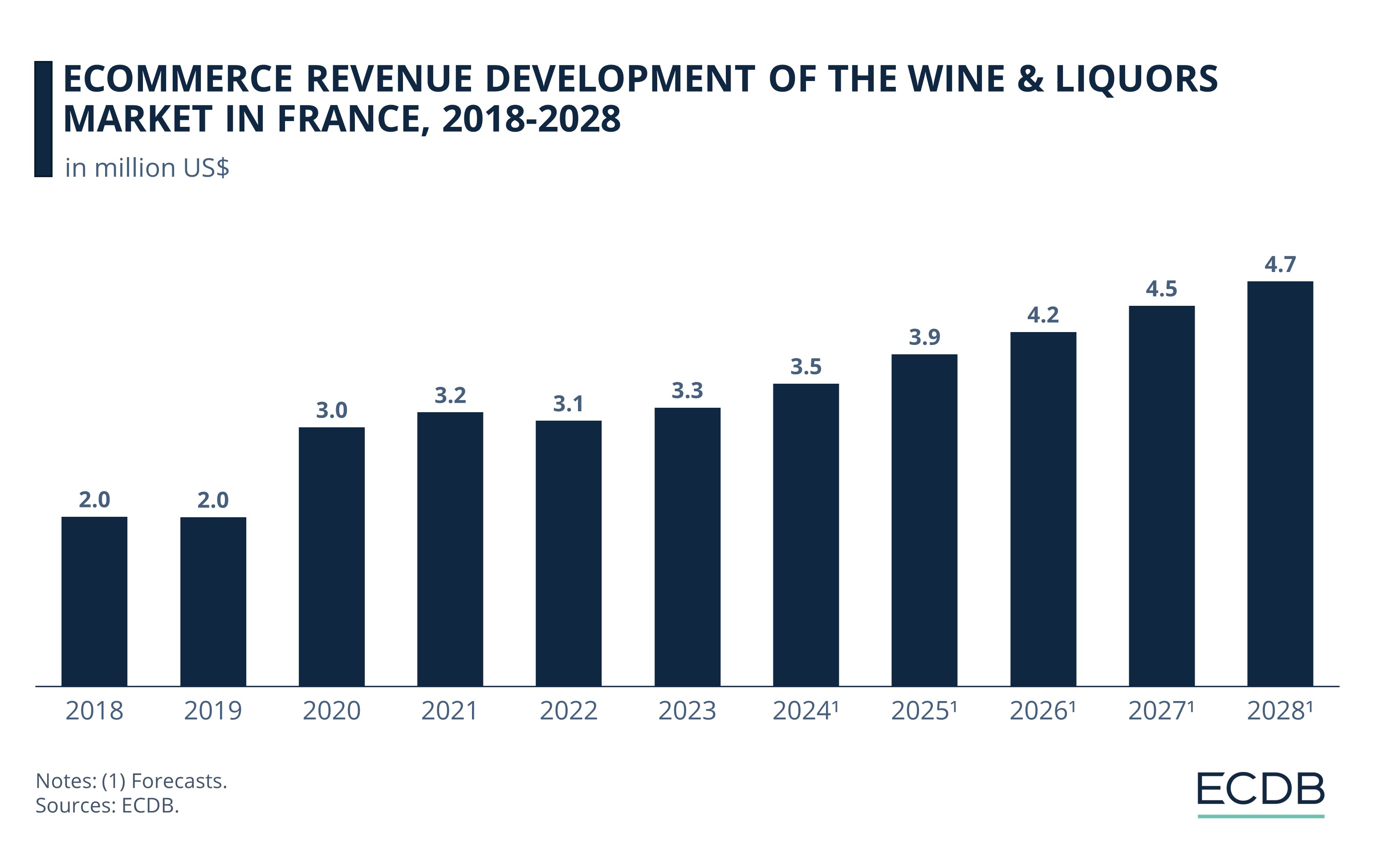

eCommerce Revenue Development in the French Wine & Liquors Market

During the COVID-19 pandemic, the French Wine & Liquors market – as many other markets – experienced significant growth in the eCommerce sector. At this point, let's take a closer look at the recent developments in this online commerce industry and how it has done and may do in the future:

2018 to 2019: The market remained stable during this period, with no significant impact on eCommerce revenue. Both years saw revenues of US$1.9 million.

2020 to 2021: The onset of the COVID-19 pandemic brought about a substantial increase in online shopping as people stayed home. In 2020, the revenue surged to US$3 million and continued to rise to US$3.2 million in 2021, marking a total increase of 61.9% from 2019 to 2021.

2022 to 2023: In the post-pandemic period, there was a slight dip in revenue to US$3.1 million in 2022, representing a 3.1% decline compared to 2021. But the market quickly regained momentum, growing by 4.9% to US$3.3 million in 2023.

2024 to 2028: Forecasts indicate that the market will enter a new phase of expansion, with a compound annual growth rate (CAGR) of approximately 8%. By 2028, the market is projected to reach a revenue of US$4.7 million.

The French Wine & Liquors eCommerce market demonstrates resilience and potential for steady growth in the years ahead, continuing to benefit from the shift to online shopping initiated during the pandemic.

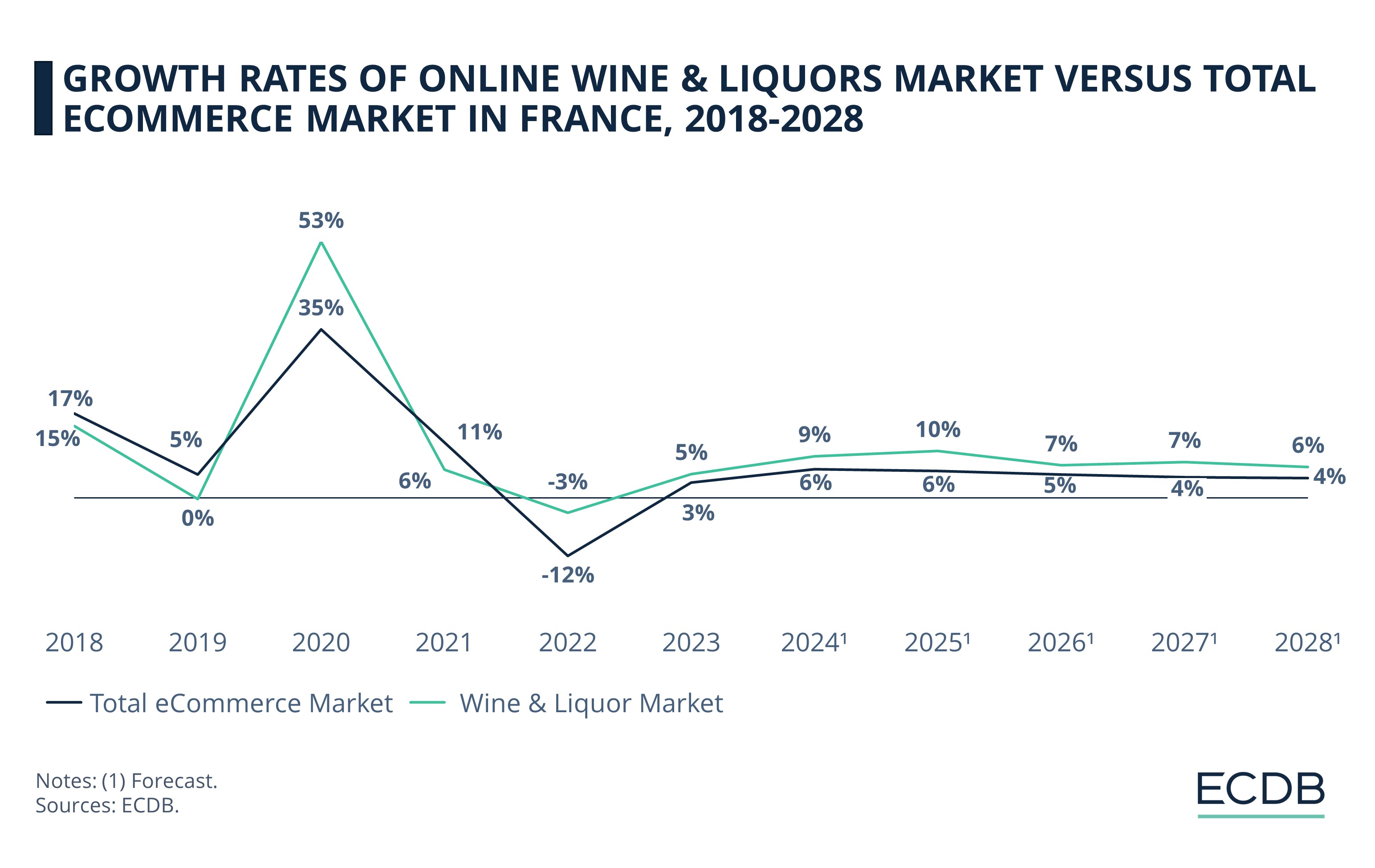

Growth Rates of Online Wine & Liquors Market vs. French eCommerce Market

The Wine & Liquors eCommerce market in France has shown a dynamic trajectory, one that is sometimes at variance with general eCommerce industry trends.

In 2018, the Wine & Liquors market expanded by 15%, slightly behind the 17% increase in the overall eCommerce sector. This trend shifted in 2020, when the Wine & Liquors market rose by a whopping 53%, significantly outpacing the 35% growth of the general eCommerce industry in France.

During 2021, both markets experienced slower growth, with the Wine & Liquors sector growing by 6% compared to the general market's 11% increase. The following year, 2022, marked a downturn for both sectors, with the general eCommerce market in France dropping 12% and the Wine & Liquors market declining 3%.

A stabilization set in with 2023, when the Wine & Liquors market increased by 5%, ahead of the general eCommerce market's 3% growth. Looking ahead to 2024, both sectors are forecast to continue to experience growth, with the Wine & Liquors market expected to advance by 9% and the general eCommerce market by 6%.

Thereafter, both markets are forecast to grow steadily through 2028. The Wine & Liquors sector is expected to show annual growth of between 6% and 10%, while the general eCommerce market is expected to maintain a more modest pace of increase of around 4% to 6%.

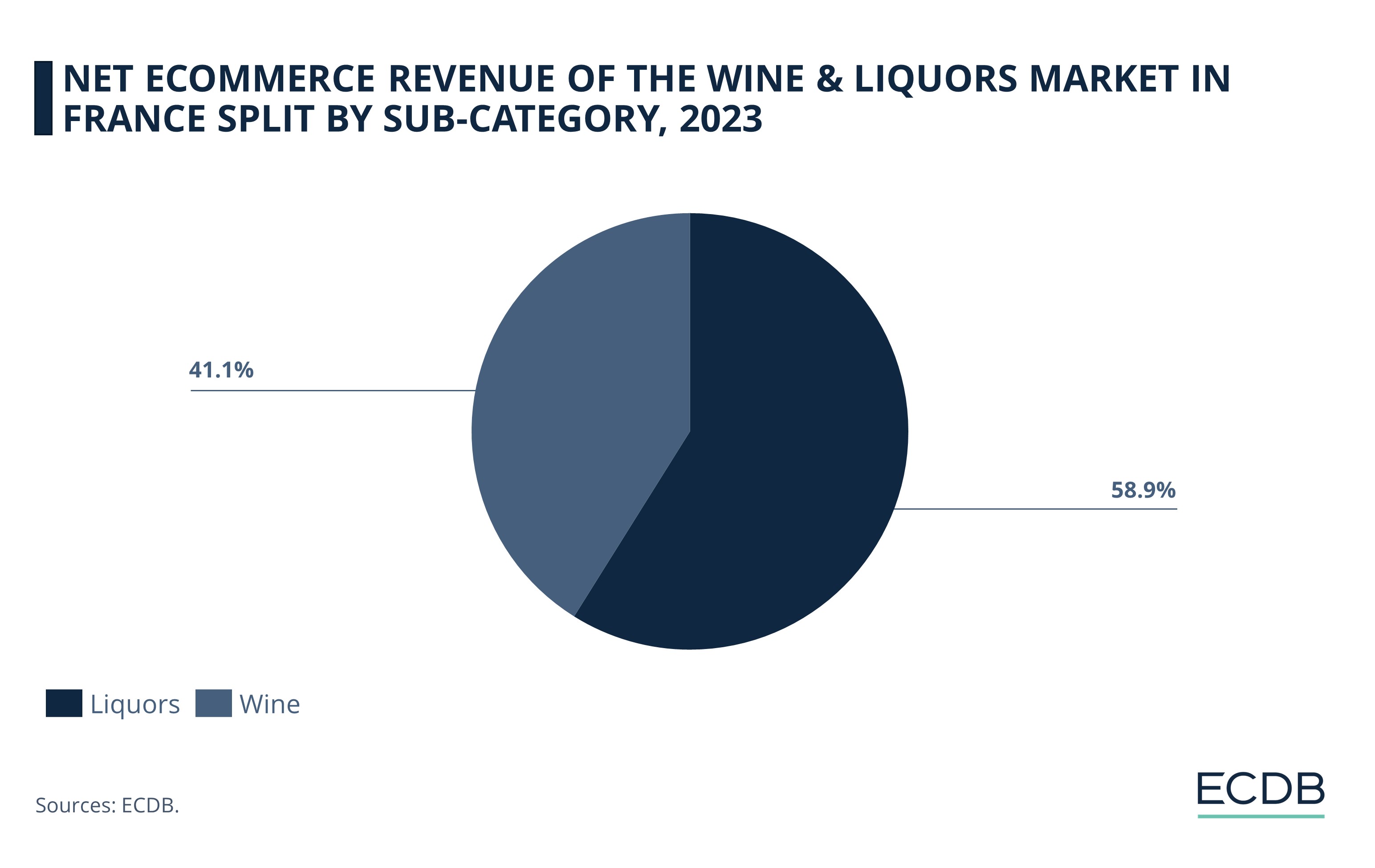

Liquors Lead the Market Share

As mentioned earlier, the Wine & Liquor category consists of two subcategories: wine and spirits. Although the general wine trade in France is the third-largest market in the world, with a turnover of US$26 billion in 2023, the grape-derived alcoholic liquid does not dominate the French eCommerce market.

With 58.9%, spirits such as whiskey, rum, vodka, tequila and gin dominate the French market. Wine follows with a 41.1% share of net eCommerce revenue. This breakdown has remained almost the same over the past few years, with minimal fluctuations in the decimal range.

Top Online Wine and Liquors Stores in France: Closing Thoughts

In France, people have an expression that perfectly captures the French culture: "l'art de vivre", which means "the art of living". Wine and alcohol in general play a key role in the French way of life, and its consumption goes far beyond the simple act of drinking an alcoholic beverage. It is deeply rooted in French culture and tradition, a symbol of sophistication and socializing.

All these are the reasons why the Wine & Liquors market is so unique and different from other countries. At the same time, it is exactly these values that are driving the industry, which is why the eCommerce market could reach an income of US$4.7 million by 2028.

Sources: ECDB, secondary sources in the referenced articles.

Related insights

Deep Dive

Top Online Do-it-Yourself (DIY) Home Improvement Retailing Market in the UK

Top Online Do-it-Yourself (DIY) Home Improvement Retailing Market in the UK

Deep Dive

China’s eCommerce Market: Top Product Categories by Growth

China’s eCommerce Market: Top Product Categories by Growth

Article

Hobby & Leisure eCommerce Revenue Development in Greater China

Hobby & Leisure eCommerce Revenue Development in Greater China

Article

Toys eCommerce Revenue Development in Greater China

Toys eCommerce Revenue Development in Greater China

Article

Sports Equipment eCommerce Revenue Development in Greater China

Sports Equipment eCommerce Revenue Development in Greater China

Back to main topics